Give Your Employees the Care They Deserve

At Trumark Health, we offer a groundbreaking way to benefit both employees and the company with one simple process.

Our Program is a section 125 Pre-Tax plan prioritizing preventative health and wellness.

Trumark Health and Wellness can be at no Net Cost for the employer and employee.

view video for complete details

How this program benefits YOU, the Employer

Receive between $480 - $620 in tax savings annually for each enrolled employee.

Employers will save over $40 each month per employee in payroll taxes without any extra cost. (see example further down page)

Trumark Enrollment Team enrolls everyone, so there's no extra burden to your HR department.

The Trumark Plan doesn't disrupt or replace your primary health insurance, rather enhances the benefits of your existing Employee Health Package.

Empower your employee recruiting and retention by adding Trumark into your benefits package.

Employees will see a monthly increase of $30 to $300 in take-home pay by participating in the program.

By using Trumark services first, employees will reduce usage of their Primary Care resulting in future savings.

Your employees will love...

No Copay.

No Deductibles.

No Coinsurance.

This plan does not disrupt or replace any Medical or Supplemental Plan. It is simply an enhancement of your current benefits for qualified employees. Most importantly, we focus on predictive & preventative health before it becomes a health insurance issue.

A Win-Win for Employees

Participating in a "125 Cafeteria Plan" reduces an Employee's taxable income and in turn increases their take-home pay while at the same time adding additional health benefits for themselves and their family members.

A BIG Win for Employers

Every dollar put through a Section 125 plan reduces an Employer's payroll through a reduction in their payroll tax liability by eliminating the matching FICA taxes of 7.65%, with the employer's tax savings starting on month two.

A Simple, Game-Changing Solution

Join the ranks of forward-thinking companies investing in the health and well-being of their employees. Contact us to learn more about how Trumark Health can transform your company's health benefits.

High Enrollment Percentages

100% Voluntary

No Underwriting

Increased Employee Retention

Happy Employees

Trumark offers six plan options to maximize employee participation and savings for the employer.

THE PROGRAM'S FOUNDATION

Unlimited Tele-Health Benefits

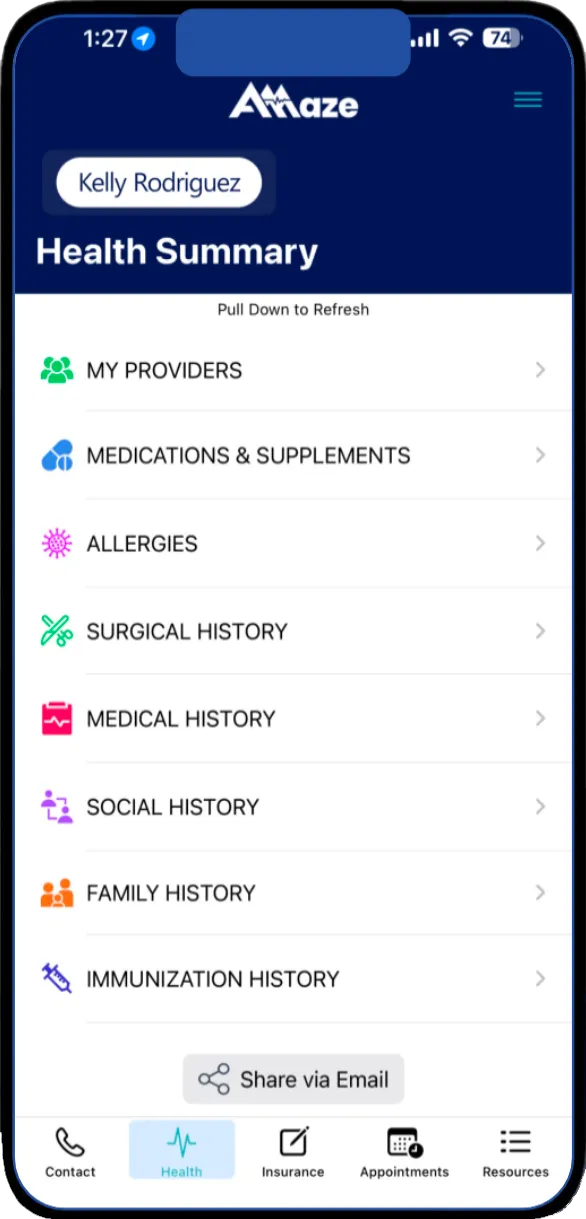

Amaze Health is the core of your Trumark Plan. Amaze is available 24/7/365 to provide medical care when you need, to answer any questions about your Trumark Plan, and to help you access your other benefits.

Virtual ER Telemedicine

Primary Care

Urgent Care

Behavioral Health

Dermatology

$0 Co-Pay Fee

Personalized Programs from Amaze...

Chronic Disease Management

Prescription Program

Billing Advocacy

Biometric Facial Scanner

Health Risk Assessments

Weight Management

Smoking Cessation

Dental Support

Chronic Disease Management

Prescription Program

Billing Advocacy

Care for the Whole Family

Some of the ways Employees use Amaze...

Virtual Urgent Care

Amaze will evaluate your situation and will often resolve the situation virtually, including writing prescriptions and ordering lab tests or imaging (like x-rays). If you need in-person help, they’ll help you decide where to go and will be with you when you do.

Chronic Medical Condition Management

Joint pain, high blood pressure, diabetes, weight loss, smoking cessation... Amaze is here to help you get healthy and stay healthy. They offer virtual physicals, order lab tests, and coach you on how to manage any medical conditions. Call them for medication refills, answers to your most pressing questions, and for any help you need managing your health.

Basic Mental Health Services

Amaze will take the struggle out of finding mental health support by providing short-term support while helping find resources in your area, and your budget.

Health & Wellness Support

Amaze can help you lose weight, quit smoking, or simply improve your diet and exercise routine. Through weekly newsletters, online assessments, and their digital education center, you will continuously learn the best ways to manage your health.

The Amaze Difference

They don’t bill you or your insurance

They stay with you until your problem is resolved

They're one click away when you need them

Plus... An Acute Medication Program with No-Cost Drugs

37 Commonly prescribed drugs at No Charge

70,000+ Retail pharmacies in the U.S.A

Discount program for drugs not on formulary

Prescription Assistance Program is available for medication over $200

Does not impact your current medical claims

Just present the Rx Card and save!

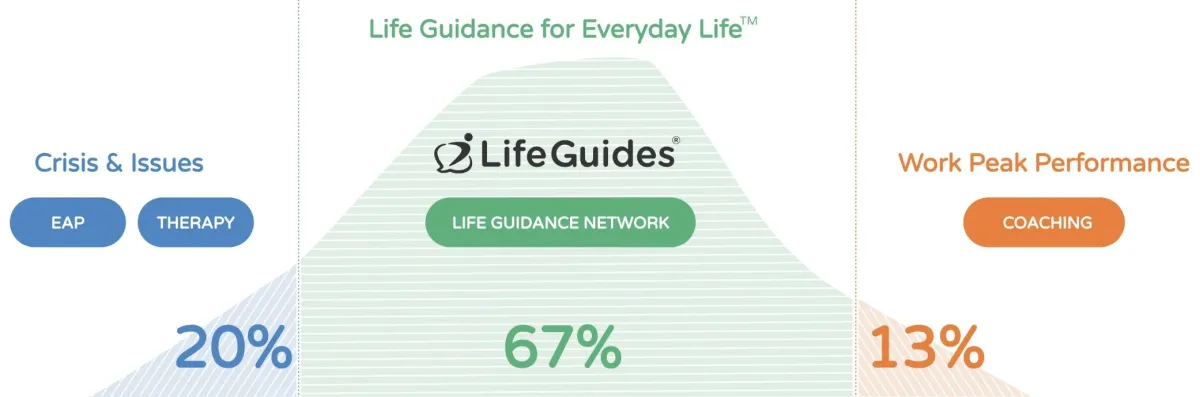

Also Includes... Unlimited Peer-to-Peer Certified Mentoring

Life Guides

Personalized Mentoring for Peak Work & Life Performance

High Perceived Value to Employee Families

Reinforce a “Culture of Caring”

Guides help ALL adult household family members thrive

Unlimited Certified Guide sessions with no employee co-pay

Filling the Gap as the

"Whole Person & Whole Life" Solution

More Casual than Therapy

More Qualified than a Friend

SHRM Used. SHRM Approved.

"The world is experiencing an empathy deficit. What I respect about LifeGuides is that as an employer, you can translate empathy into compassion in action."

— Johnny C. Taylor, CEO of SHRM

Chairman, LifeGuides "Social Impact Council"

Employees choose from a community of Certified LifeGuides with matched life experience in one of 400+ topics of Personal Growth, Lifelong Learning, and Life Challenges.

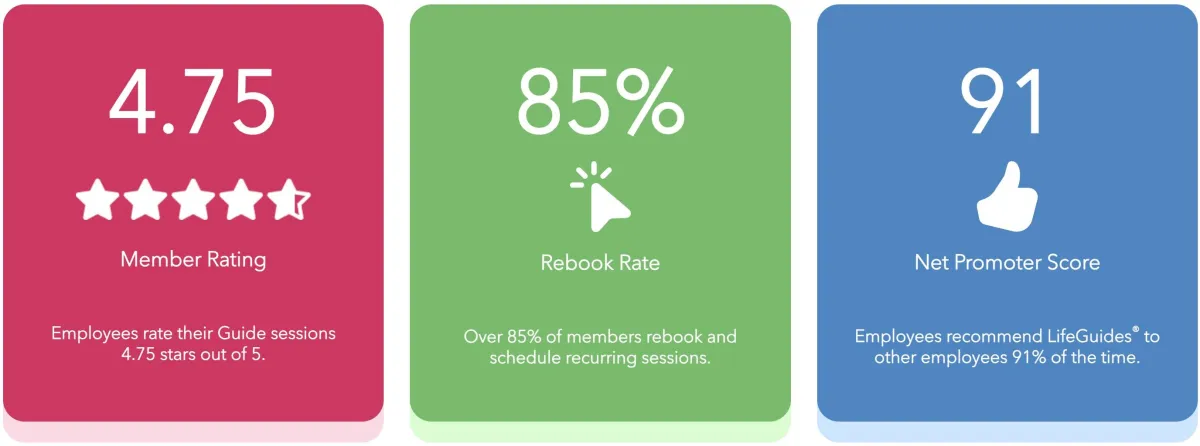

Employees Love their Guide Sessions

Valued by Leading Companies Including:

And for the Employer... an Incredible Tax Savings Benefit!

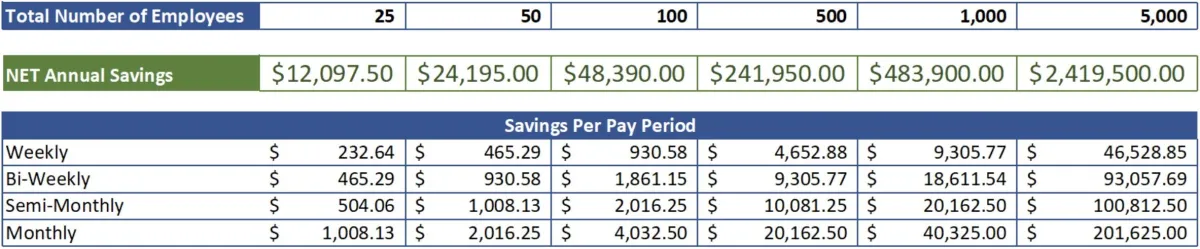

Employer Savings Example

Average Savings Calculations

Savings Per Employee

Per Month: $80.32

Per Year: $963.84

Admin Cost Per Employee

Per Month: $40.00

Per Year: $480.00

Net Savings Per Employee

After Trumark Health Fee

Per Month: $40.33

Per Year: $483.90

Average Savings Per Year Per Employee: $483.90

Expanded Example of the Average Savings Multiplied by Employee Count

Get Started Today by Booking a Call

to Discuss Your Business Options

Join the ranks of forward-thinking companies investing in the health and well-being of their employees.

Contact us to learn more about how Trumark Health can transform your company's health benefits.

Count on Trumark Health as your dedicated partner in navigating the intricacies of Section 125 Tax Credits. Beyond mere cost savings, we're devoted to the long term health of your employees and their families.

With a thorough understanding of the complexities involved, we're committed to tailoring a Section 125 "Cafeteria Plan" specifically for your needs and those of your employees. These plans can put more money back into the pockets of both your employees and your business, while at the same time providing additional health benefits. Truly, it's a Win-Win combination.

Let's work together to pave the way for a healthy and prosperous future for everyone in your business.

Trust Trumark Health to stand by your side on this journey.

Ramon Fazah

916-866-5645

Trumark Health, Director of Enterprise Relationships

© 2024 Trumark Health LLC • All Rights Reserved